MODULE 6 REVIEW

1.Cash equivalents:A) Are short-term, highly liquid investments

B) Include 6-month CDs

C) Include checking accounts

D) Are recorded in petty cash

E) Include money orders2.The importance of cash is highlighted by the inclusion of a statement of cash flows in a complete set of financial statements, which reports on the changes in cash.A) True

B) False3.It is not necessary for businesses to reconcile their checking accounts since banks keep accurate records and provide internal control support for cash.A) True

B) False4.Basic bank services such as bank accounts, bank deposits and checking contribute to the control and safeguarding of cash.A) True

B) False5.The payee is the person who signs a check and authorizes payment.A) TrueB) False6.At the end of the day, the cash register's record shows $1,000 but the count of cash in the register is $1,035. The proper entry to record this excess includes a:A) Credit to Cash for $35

B) Debit to Cash for $35

C) Credit to Cash Over and Short for $35

D) Debit to Cash Over and Short for $35

E) Debit to Petty Cash for $357.In Year 1 a company had net sales of $50,000 and ending accounts receivable of $2,000. In Year 2 this company had net sales of $80,000 and ending accounts receivable of $4,000. Use days' sales uncollected to determine which of the following statements is true?A) Days' sales uncollected in Year 1 is 14.6 days and in Year 2 is 18.25 days. This measure indicates that the company's liquidity is declining

B) Days' sales uncollected in Year 1 is 14.6 days and in Year 2 is 18.25 days. This measure indicates that the company's liquidity is improving

C) Days' sales uncollected in Year 1 is 25 days and in Year 2 is 20 days. This measure indicates that the company's liquidity is declining

D) Days' sales uncollected in Year 1 is 25 days and in Year 2 is 20 days. This measure indicates that the company's liquidity is improving

E) Days' sales uncollected in Year 1 is .04 days and in Year 2 is .05 days. This measure indicates that the company's liquidity is improving8.Bonding does not discourage employees from stealing from the company as employees know that bonding is an insurance policy against loss from theft.A) True

B) False9.An invoice is a document that is used within a company to notify the appropriate persons that ordered goods have been received and to describe the quantities and condition of the goods.A) True

B) False10.A company had net sales of $31,500 and ending accounts receivable of $2,700 for the current period. Its days' sales uncollected is equal to:A) 11.7 days

B) 23.3 days

C) 31.3 days

D) 42.5 days

E) 46.6 days11.Cancelled checks are checks the bank has paid and deducted from the customer's account during the period.A) True

B) False12.Recording a purchase is initiated by an invoice approval, not an invoice.A) True

B) False13.At the end of the day, the cash register's record shows $1,250, but the count of cash in the cash register is $1,245. The correct entry to record the cash sales for the day is:A)

B)

C)

D)

E)

14.In reimbursing the petty cash fund:A) Cash is debited

B) Petty Cash is credited

C) Petty Cash is debited

D) Appropriate expense accounts are debited

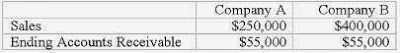

E) No expenses are recorded15.Which of the following statements is true given the data below?

A) Both companies have the same degree of liquidity with regard to their accounts receivables

B) Company A is likely to collect account receivables more quickly than Company B

C) Company B is likely to collect account receivables more quickly than Company A

D) Company A and Company B will likely collect account receivables at the same time

E) It is impossible to estimate how much time it will take for these companies to collect their receivable based on the given information16.An NSF check for $17.50 would be recorded as a debit to Cash and a credit to Accounts Receivable.A) True

B) False17.Cash equivalents are short-term highly liquid investment assets that are easily converted to cash and have maturities of one year.A) True

B) False18.Cash receipts by mail require only two people: One to open the mail and a second person to deposit the cash in the bank and record the cash receipt in the accounting records.A) True

B) False19.The principles of internal control include: establish responsibilities, maintain adequate records, insure assets, separate recordkeeping from custody of assets and perform regular and independent reviews.A) True

B) False20.Fluffy Pet Grooming deposits all cash receipts on the day when they are received and all cash payments are made by check. At the close of business on June 30, its Cash account shows a $14,811, debit balance. Fluffy Pet Grooming's June 30 bank statement shows $14,472 on deposit in the bank. Prepare a bank reconciliation: for Fluffy Pet Grooming using the following information

What is the adjusted bank balance?

B) $14,745

C) $14,677

D) $14,538

E) $14,877