1.

Other names for the income statement are the earnings statement, statement of

operations or a profit and loss statement.

A) True

B) False

2.

If insurance coverage for the next three years is paid for in advance, the

amount of the payment is debited to an asset account called Prepaid Insurance.

A) True

B) False

3.

A company had the following account balances at year-end:

If all of the accounts have normal balances, what are the totals for the

trial balance?

A) $186,600

B) $104,800

C) $209,600

D) $45,200

E) $67,000

4.

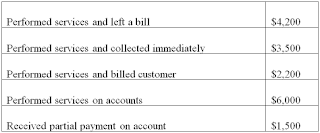

What would be the account balance in the revenue ledger account after the

following transactions?

A) $9,000

B) $15,900

C) $17,400

D) $14,400

E) $10,900

5.

What would be the appropriate entry for the following transaction?

Bill Co. performed $5,200 in consulting services on account

A) Credit to Cash, Debit to Accounts Receivable

B) Debit to Revenue, Credit to Cash

C) Debit to Accounts Receivable, Credit to Revenue

D) Debit to Accounts Receivable, Credit to Cash

E) Debit to Revenue, Debit to Cash

6.

Common Stock normally has a debit balance.

A) True

B) False

7.

The trial balance can serve as a replacement for the balance sheet, since debits

must balance with credits.

A) True

B) False

8.

A transaction that decreases an asset account and increases a liability account

must also affect one or more other accounts.

A) True

B) False

9.

A company that finances a relatively large portion of its assets with

liabilities is said to have a high degree of financial leverage.

A) True

B) False

10.

These transactions were completed by the art gallery opened by Zed Bennett.

Started the gallery, Artery, by investing $40,000 cash and equipment valued at

$18,000 in exchange for common stock.

Purchased $70 of office supplies on credit.

Paid $1,200 cash for the receptionist's salary.

Sold a painting for an artist and collected a $4,500 cash commission on the

sale.

Completed an art appraisal and billed the client $200.

What was the balance of the cash account after these transactions were posted?

A) $12,430

B) $12,230

C) $43,300

D) $61,430

E) $43,430

11.

Credits always increase account balances.

A) True

B) False

12.

Which of the following statements is correct?

A) When a future expense is paid in advance, the payment is normally recorded in

a liability account called Prepaid Expense

B) Promises of future payment are called accounts payable

C) Increases and decreases in cash are always recorded in the retained earnings

account

D) Accrued liabilities include accounts receivable

E) An account called Land is commonly used to record increases and decreases in

both the land and buildings owned by a business

13.

Which of the following is the appropriate journal entry if a company performs a

service and then bills the customer?

A) Debit to Cash, Debit to Revenue

B) Debit to Accounts Receivable, Credit to Revenue

C) Debit to Revenue, Credit to Accounts Receivable

D) Debit to Cash, Credit to Revenue

E) Debit to Accounts Receivable, Credit to Cash

14.

The heading on each financial statement lists the three W's - Who (the name of

the organization), What (the name of the statement) and Where (the

organization's address).

A) True

B) False

15.

Preparation of a trial balance is the first step in the analyzing and recording

process.

A) True

B) False

16.

What would be the account balance in the accounts receivable ledger account

after the following transactions?

A) $10,900

B) $17,400

C) $14,400

D) $2,000

E) $4,500

17.

An asset created by prepayment of an expense is:

A) Recorded as a debit to an unearned revenue account

B) Recorded as a credit to a prepaid expense account

C) Recorded as a credit to an unearned revenue account

D) Recorded as a debit to a prepaid expense account

E) Not recorded in the accounting records until the earnings process is complete

18.

The debt ratio is calculated by dividing total assets by total liabilities.

A) True

B) False

19.

The record in which transactions are first recorded is the:

A) Journal

B) Account balance

C) Ledger

D) Trial balance

E) Cash account

20.

The general ledger of a business

A) Is a collection of all accounts used in a company's information system

B) A and B

C) A, B and D

D) Must be kept in a computer file

E) Is a set standard not affected by a company's size and diversity

Show Answers

skip to main |

skip to sidebar

Popular Posts

-

1. The acid-test ratio differs from the current ratio in that: A) The acid-test ratio excludes short-term investments from the ca...

-

MODULE 8 1. A company purchased equipment valued at $200,000 on January 1. The equipment has an estimated useful life of six year...

-

1. The lower of cost or market rule for inventory valuation must be applied to each individual unit separately and not to major categori...

-

MODULE 7 REVIEW 1. Wallah Company agreed to accept $5,000 in cash along with an $8,000, 90-day, 13.5% note from customer Judit...

-

1. Decreases in retained earnings that represent costs of assets or services that are used to earn revenues are called: A) Contributed Ca...

-

Chapter 2 Serial Problem On October 1, 2011, Santana Rey launched a computer services company called Business Solutio...

-

1. Other names for the income statement are the earnings statement, statement of operations or a profit and loss statement. A) True B) F...

-

MODULE 6 REVIEW 1. Cash equivalents: A) Are short-term, highly liquid investments B) Include 6-month CDs C) Include chec...

-

Chapter 1 Serial Problem On October 1, 2011, Santana Rey launched a computer services company, Business Solutions, that...

-

MODULE 9 REVIEW 1. Vacation benefits are a form of estimated liabilities for an employer. A) True B) False 2. An...

Copyright © 2011 Financial Accounting - ACG2021

Blogger Templates for Painting Furniture. CSS Template by Ramblingsoul