1.

Decreases in retained earnings that represent costs of assets or services that

are used to earn revenues are called:

A) Contributed Capital

B) Expenses

C) Withdrawals

D) Equity

E) Liabilities

2.

Revenues are:

A) Increases in retained earnings from a company's earning activities

B) Resources owned or controlled by a company

C) The costs of assets or services used

D) The same as net income

E) The excess of expenses over assets

3.

A corporation:

A) Is a legal entity separate and distinct from its owners

B) Has shareholders who have unlimited liability for the acts of the corporation

C) Must have many owners

D) Is the same as a limited liability partnership

E) Does not have to pay taxes

4.

The first section of the income statement reports cash from operations.

A) True

B) False

5.

Beginning Assets were $437,600, Beginning Liabilities were $262,560, Common

Stock sold during the year totaled $45,000, Revenue for the year was $414,250,

Expenses for the year were $280,000, Dividends declared was $22,700, and Ending

Liabilities is $350,000.

What is Net Income for the year?

A) $612,560

B) $134,250

C) $331,590

D) $700,160

E) $175,040

6.

Ending Liabilities are 67,000, Beginning Equity was $87,000, Common Stock sold

during year totaled $31,000, Expenses for the year were $22,000, Dividends

declared totaled $13,000, Ending Equity for the year is $181,000 and Beginning

Assets for the year were $222,000.

What was Beginning Liabilities for the year?

A) $212,000

B) $155,000

C) $154,000

D) $135,000

E) $248,000

7.

Accounts payable appear on which of the following statements?

A) Income statement

B) Statement of cash flows

C) Transaction statement

D) Balance sheet

E) Statement of retained earnings

8.

Which of the following statements is not true about assets?

A) They appear on the balance sheet

B) They are economic resources owned or controlled by the business

C) They are expected to provide future benefits to the business

D) They appear on the statement of retained earnings

E) Claims on them are shared between creditors and owners

9.

Managerial accounting is an area of accounting that provides internal reports to

assist the decision making needs of internal users.

A) True

B) False

10.

To include the personal assets and transactions of a business's owner in the

records and reports of the business would be in conflict with the:

A) Revenue recognition principle

B) Going-concern principle

C) Objectivity principle

D) Realization principle

E) Business entity principle

11.

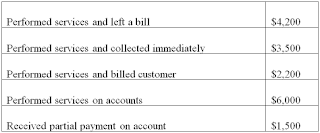

Below is accounting information for Cascade Company for 2010:

What was Total Equity for the year?

A) $116,000

B) $457,000

C) $316,000

D) $296,000

E) $320,000

12.

The area of accounting aimed at serving the decision making needs of internal

users is:

A) Governmental accounting

B) External auditing

C) SEC reporting

D) Managerial accounting

E) Financial accounting

13.

Which of the following elements are found on the income statement?

A) Retained Earnings

B) Salaries Expense

C) Accounts Receivable

D) Common Stock

E) Cash

14.

Revenues are increases in retained earnings from a company's earnings

activities.

A) True

B) False

15.

How would the accounting equation of Boston Company be affected by the billing

of a client for $10,000 of consulting work completed?

A) + $10,000 accounts receivable, + $10,000 cash

B) + $10,000 accounts receivable, + $10,000 accounts payable

C) + $10,000 accounts receivable, -$10,000 consulting revenue

D) + $10,000 accounts receivable, -$10,000 accounts payable

E) + $10,000 accounts receivable, + $10,000 consulting revenue

16.

The International Accounting Standards Board (IASB) is the government group that

establishes reporting requirements for companies that issue stock to the public.

A) True

B) False

17.

Assets are the resources owned or controlled by a business.

A) True

B) False

18.

Acme Company had equity of $55,000 at the end of the current year. During the

year the company had a $2,000 net loss and investments by owners in exchange for

stock of $7,000. Compute equity as of the beginning of the year.

A) $64,000

B) $50,000

C) $52,000

D) $46,000

E) $5,000

19.

Internal users of accounting information include lenders, shareholders, brokers

and managers.

A) True

B) False

20.

An exchange of value between two entities is called:

A) A business transaction

B) Recordkeeping or bookkeeping

C) The accounting equation

D) Net Income

E) An asset

21.

The legitimate claims of a business's creditors take precedence over the claims

of its stockholders.

A) True

B) False

22.

Investing activities are the acquiring and selling of resources that an

organization uses in its everyday operations.

A) True

B) False

23.

Owner's investments and dividends are reported on the income statement.

A) True

B) False

24.

If the liabilities of a business increased $75,000 during a period of time and

the equity in the business decreased $30,000 during the same period, the assets

of the business must have:

A) Increased $45,000

B) Decreased $45,000

C) Increased $105,000

D) Decreased $105,000

E) Increased $30,000

25.

A company reported total equity of $145,000 on its December 31, 2008, balance

sheet. The following information is available for the year ended December 31,

2009:

What are the total assets of the company at December 31, 2009?

A) $92,000

B) $45,000

C) $282,000

D) $210,000

E) $190,000

26.

Congress passed the Sarbanes-Oxley Act to

A) Help curb financial abuses at companies that issue their stock to the public

B) Provide jobs to U.S. accountants and limit the number of jobs sent outside

the country

C) Require that all companies publicly disclose their internal control plans

D) Impose penalties on CEO's and CFO's who knowingly sign off on bogus

accounting reports, although at this time the penalties are token amounts

E) Force auditors to attest to the absolute accuracy of the financial statements

27.

The income statement shows the financial position of a business on a specific

date.

A) True

B) False

28.

The primary objective of financial accounting is to provide general-purpose

financial statements to help external users analyze and interpret an

organization's activities.

A) True

B) False

29.

A balance sheet lists:

A) The assets and liabilities of a company, but not the equity

B) Only the information about what happened to retained earnings during a time

period

C) The cash inflows and outflows during the period

D) The types and amounts of the revenues and expenses of a business

E) The types and amounts of assets, liabilities and equity of a business as of a

specific date

30.

Fast-Forward has beginning equity of $257,000, net income of $51,000, dividends

of $40,000 and investments by owners in exchange for stock of $6,000. Its ending

equity is:

A) $208,000

B) $240,000

C) $223,000

D) $274,000

E) $268,000

31.

Expenses decrease retained earnings and are the costs acquired to earn revenues.

A) True

B) False

32.

Bookkeeping is the sole purpose of accounting.

A) True

B) False

33.

The four basic financial statements include the balance sheet, income statement,

statement of retained earnings and statement of cash flows.

A) True

B) False

34.

Accounting is one way important information about businesses are reported to

decision makers.

A) True

B) False

35.

Another name for equity is:

A) Expenses

B) Net income

C) Net loss

D) Revenue

E) Net assets

36.

Fast-Forward had cash inflows from operations of $62,500; cash outflows from

investing activities of $47,000; and cash inflows from financing of $25,000. The

net change in cash was:

A) $134,500 decrease

B) $9,500 increase

C) $40,500 decrease

D) $134,000 increase

E) $40,500 increase

Show Answers

1.

Decreases in retained earnings that represent costs of

assets or services that are used to earn revenues are called:

B) Expenses

2.

Revenues are:

A) Increases in

retained earnings from a company's earning activities

3.

A corporation:

A) Is a legal entity

separate and distinct from its owners

4.

The first section of the income statement reports cash

from operations.

A) True

5.

Beginning Assets were $437,600, Beginning Liabilities

were $262,560, Common Stock sold during the year totaled $45,000, Revenue

for the year was $414,250, Expenses for the year were $280,000, Dividends

declared was $22,700, and Ending Liabilities is $350,000.

What is Net Income for the year?

B) $134,250

6.

Ending Liabilities are 67,000, Beginning Equity was

$87,000, Common Stock sold during year totaled $31,000, Expenses for the

year were $22,000, Dividends declared totaled $13,000, Ending Equity for the

year is $181,000 and Beginning Assets for the year were $222,000.

What was Beginning Liabilities for the year?

E) $248,000

7.

Accounts payable appear on which of the following

statements?

D) Balance sheet

8.

Which of the following statements is not true about

assets?

D) They appear on the

statement of retained earnings

9.

Managerial accounting is an area of accounting that

provides internal reports to assist the decision making needs of internal

users.

A) True

10.

To include the personal assets and transactions of a

business's owner in the records and reports of the business would be in

conflict with the:

E) Business entity

principle

11.

Below is accounting information for Cascade Company for

2010:

What was Total Equity for the year?

C) $316,000

12.

The area of accounting aimed at serving the decision

making needs of internal users is:

D) Managerial

accounting

13.

Which of the following elements are found on the income

statement?

B) Salaries Expense

14.

Revenues are increases in retained earnings from a

company's earnings activities.

A) True

15.

How would the accounting equation of Boston Company be

affected by the billing of a client for $10,000 of consulting work

completed?

E) + $10,000 accounts

receivable, + $10,000 consulting revenue

16.

The International Accounting Standards Board (IASB) is

the government group that establishes reporting requirements for companies

that issue stock to the public.

B) False

17.

Assets are the resources owned or controlled by a

business.

A) True

18.

Acme Company had equity of $55,000 at the end of the

current year. During the year the company had a $2,000 net loss and

investments by owners in exchange for stock of $7,000. Compute equity as of

the beginning of the year.

B) $50,000

19.

Internal users of accounting information include

lenders, shareholders, brokers and managers.

B) False

20.

An exchange of value between two entities is called:

A) A business

transaction

21.

The legitimate claims of a business's creditors take precedence over the claims

of its stockholders.

A)

True

22.

Investing activities are the acquiring and selling of resources that an

organization uses in its everyday operations.

A)

True

23.

Owner's investments and dividends are reported on the income statement.

B)

False

24.

If

the liabilities of a business increased $75,000 during a period of time and the

equity in the business decreased $30,000 during the same period, the assets of

the business must have:

A)

Increased $45,000

25.

A

company reported total equity of $145,000 on its December 31, 2008, balance

sheet. The following information is available for the year ended December 31,

2009:

What are

the total assets of the company at December 31, 2009?

C)

$282,000

26.

Congress passed the Sarbanes-Oxley Act to

A)

Help curb financial abuses at companies that issue their stock to the public

27.

The income statement shows the financial position of a business on a specific

date.

A)

True

28.

The primary objective of financial accounting is to provide general-purpose

financial statements to help external users analyze and interpret an

organization's activities.

A)

True

29.

A

balance sheet lists:

E)

The types and amounts of assets, liabilities and equity of a business as of a

specific date

30.

Fast-Forward has beginning equity of $257,000, net income of $51,000, dividends

of $40,000 and investments by owners in exchange for stock of $6,000. Its ending

equity is:

D)

$274,000

31.

Expenses decrease retained earnings and are the costs acquired to earn revenues.

A)

True

32.

Bookkeeping is the sole purpose of accounting.

B)

False

33.

The four basic financial statements include the balance sheet, income statement,

statement of retained earnings and statement of cash flows.

A)

True

34.

Accounting is one way important information about businesses are reported to

decision makers.

A)

True

35.

Another name for equity is:

E)

Net assets

36.

Fast-Forward had cash inflows from operations of $62,500; cash outflows from

investing activities of $47,000; and cash inflows from financing of $25,000. The

net change in cash was:

E)

$40,500 increase